– Sajida A Zubair

The growing reliance on mobile phones for banking, shopping, and communication has given scammers a larger playing field to exploit. Cybercrime complaints are soaring in India, with a staggering 1.55 million cases registered by 2023 – a 60.9% rise compared to 2022, according to data from the National Crime Records Bureau (NCRB) and the Indian Cyber Crime Coordination Centre. Emerging trends show that consumers need to be vigilant about the rising tricks of scams.

Popular Mobile Scam Types: Their modus operandi

- TRAI Scam Calls

They identify themselves as representatives of Telecom Regulatory Authority of India (TRAI), claiming that the victim’s phone number has been linked to illicit activity. Con artists demand payment in order to halt the process and threaten to terminate clients’ services.

Keep in mind that the TRAI cannot cause service outages; only service providers can.

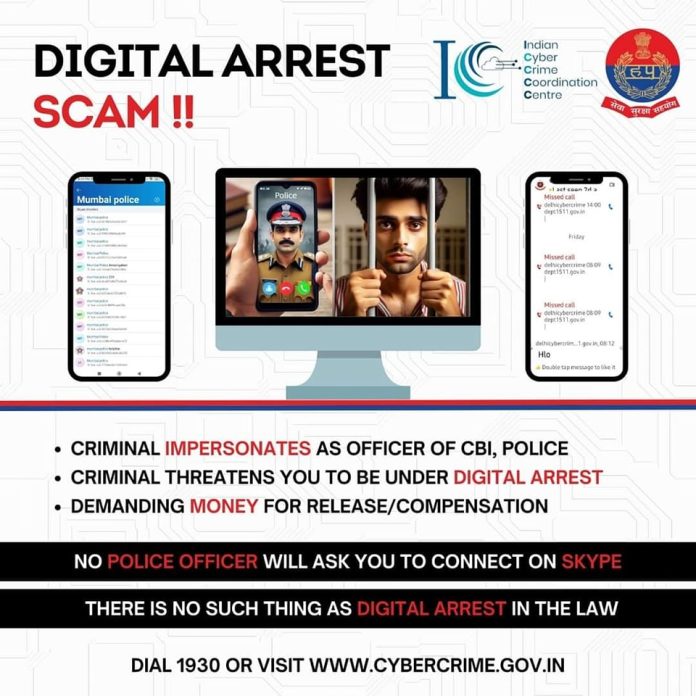

- Threats of Digital Arrest

This fraud scheme frequently involves phony police officers threatening to arrest someone on a false charge, like smuggling. Sometimes it even reaches the point of video chats with ‘officers,’ where the victims are forced to wire the enormous sums and barricade themselves inside to escape being imprisoned.

In three months, around 600 cases were filed in the NCR alone, with damages totaling more than ₹20 lakh each. Early in 2024, 28 cases were discovered in Indore, with a total loss of ₹2.5 crore.

- Family Member Scams

These scams prey on people’s emotions by claiming that a family member has been arrested. Some scammers even use artificial intelligence (AI) capabilities to imitate the family members’ voices in order to demand bailout money. If such a call is received, the individual will immediately contact the family member to verify the details.

- Investment Scams

In such scams prominent social media advertisement promises a 30-40% increase. Scammers use fictitious portfolios that show early earnings to lure victims. The offender vanishes as soon as someone attempts to withdraw their money.

- Fake Money Transfers and Alerts

In fake money transfers and alerts, victim is notified that funds were inadvertently transferred to his account and that he must reimburse them. Never respond to such unwanted calls and always double-check your bank statements.

- KYC Update Phishing

Phishing mails employ links to ask users to update their KYC information. Reputable financial organisations never send out SMS requests for these updates. To update your KYC, you must go to the official branch or get in touch with the bank.

- Credit Card and Tax Refund Fraud

They deceive the victim into giving up private information over the phone about fraud involving credit card theft or tax refund acceleration. Keep in mind that tax officials and banks never request such private information over the phone. Prior to sharing any information, always get confirmation from the organisation.

It can be seen from the recent cases that the scams are getting sophisticated. Recently, in Delhi, two convicts operating from within a jail have managed to scam one person for ₹5 lakh. More such cases from Punjab state further reinforce the fact that the entire country needs to stand alert against these scams. Doctors and engineers are not alone as students too have become the victims of these scams.

Courier companies like FedEx have announced publicly that they never solicit personal information over unsolicited telephone calls. Even the police authorities claim they never threaten anyone with arrest over the phone and neither do they demand money.

How to Protect Yourself from Scams

Verify the Facts: Never accept anything told to you over the phone. Always verify it with authentic sources.

Never Disclose Your Information: Never disclose your personal or banking details to anyone over the unsolicited telephone calls.

Raise awareness to educate others: Share the problem with friends and family members especially older adults. They, more often than not will fall for these scams, as they lack the skill to distinguish them.

Report Suspicious Activity: Inform cybercrime authorities of any attempted scam attempt.

This would call for you to understand how such scams work.

Remember, whenever in doubt, just hang up and report suspicious activities to the relevant organisations so that verification could be made from respective sources. Education to keep oneself informed keeps changing with evolving digital crimes, to be on one’s guard for protection as well as of others.