New Delhi: Sahulat Microfinance Society has been honoured with the prestigious title of ‘Best Islamic Microfinance Entity of the Year 2023-24’ at an award ceremony hosted by the Islamic Finance Forum for South Asia (IFFSA) on Tuesday. The accolade acknowledges Sahulat’s transformative contributions to improving the lives of low-income groups in India.

The award ceremony was part of a larger conference on interest-free finance in South Asia, organised by IFFSA in Colombo from November 25-26. The event brought together institutions and scholars from various countries, including India, Sri Lanka, Bangladesh, Maldives, Malaysia, and South Africa, to discuss the growth and sustainability of the Islamic finance sector.

On receiving the award, Usama Khan, CEO of Sahulat, extended thanks to the IFFSA team for fostering collaboration within the Islamic finance fraternity. He also expressed heartfelt gratitude to Sahulat’s cooperatives, directors, staff, mentors, and affiliated organisations for their dedication to advancing interest-free microfinance and improving the socio-economic conditions of the economically active poor in India, regardless of caste, creed, or gender.

On receiving the award, Usama Khan, CEO of Sahulat, extended thanks to the IFFSA team for fostering collaboration within the Islamic finance fraternity. He also expressed heartfelt gratitude to Sahulat’s cooperatives, directors, staff, mentors, and affiliated organisations for their dedication to advancing interest-free microfinance and improving the socio-economic conditions of the economically active poor in India, regardless of caste, creed, or gender.

Sahulat operates as an umbrella organisation in India, focusing on establishing interest-free credit cooperative societies, capacity building, research, and advocacy to promote a conducive regulatory framework for interest-free microfinance.

Sahulat operates as an umbrella organisation in India, focusing on establishing interest-free credit cooperative societies, capacity building, research, and advocacy to promote a conducive regulatory framework for interest-free microfinance.

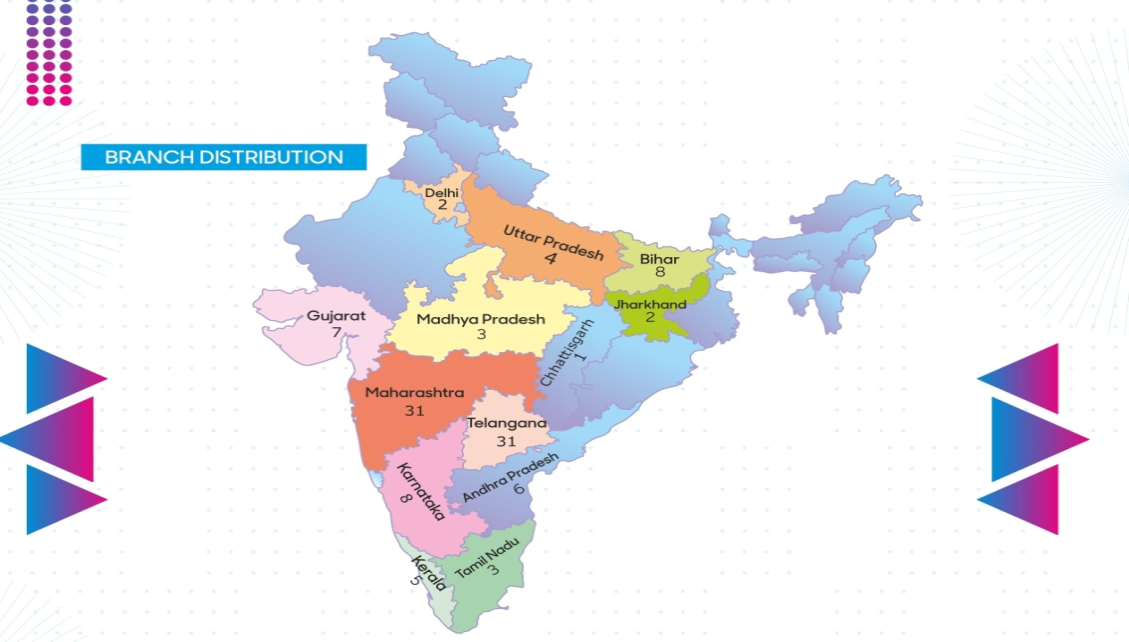

Currently, 63 cooperatives under Sahulat’s guidance operate across 13 states with 117 branches, including Bihar, Jharkhand, Uttar Pradesh, Madhya Pradesh, Chhattisgarh, Delhi, Gujarat, Maharashtra, Andhra Pradesh, Telangana, Karnataka, Kerala, and Tamil Nadu. These branches serve over 350,000 low-income families, facilitating thrift and mobilising deposits of ₹1,460 crores during the financial year 2023-24.

The deposits collected by Sahulat-affiliated cooperatives are used to meet withdrawal demands and create a pool for interest-free loans or financings, supporting both consumption and business activities of their members. The financing models include:

The deposits collected by Sahulat-affiliated cooperatives are used to meet withdrawal demands and create a pool for interest-free loans or financings, supporting both consumption and business activities of their members. The financing models include:

- Demand Loans: Interest-free cash loans for consumption, with borrowers covering only service charges.

- Murabaha (Deferred Payment): Markup or profit charged on asset purchases.

- Working Capital Finance: Profit/loss sharing agreements for small business ventures.

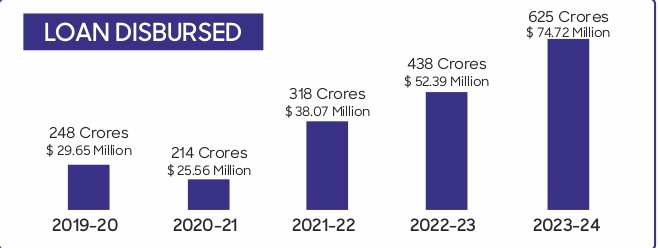

The demand loan and Murabaha models dominate the cooperative activities, with ₹625 crores disbursed during 2023-24 for consumption and livelihood initiatives.

Over the past 13 years, Sahulat has established a strong foundation for interest-free financing in India, demonstrating that:

- Practising interest-free finance is viable under existing cooperative laws.

- Interest-free deposit mobilisation is achievable at significant scales.

- Interest-free financing can sustain institutions while ensuring compliance.